Bespoke Solutions, Executed Securely.

Learn About Our Services

-

We help clients identify and mitigate market exposure with precision.

Through tailored hedging strategies and access to leading liquidity providers, Monroe delivers clarity, control, and confidence in every trade. -

Our team provides strategic market insight and execution guidance to help clients navigate complex FX environments.

-

We collaborate with leading financial institutions and fintech providers to deliver seamless market access and bespoke solutions.

Our network ensures clients benefit from competitive pricing, trusted execution, and long-term value.

Why Monroe

With a growing footprint across more than a dozen markets, Monroe has built a reputation for consistency, precision, and trust. Our clients range from multinational corporates to leading financial institutions — each benefiting from our deep market access, tailored execution, and commitment to delivering results across global currencies.

Our track record reflects more than reach, it reflects reliability. Every transaction, partnership, and strategy is underpinned by a disciplined approach to risk management and a commitment to long-term client relationships. Monroe’s independence allows us to act decisively and transparently, ensuring every outcome aligns with our clients’ objectives.

Testimonials:

“Partnering with Monroe has elevated our entire hedging strategy. They provide direct access to tier-one liquidity and tailored structures that our bank simply couldn’t match.”

— Managing Director, (£300M+ Turnover)

“Monroe consistently delivers institutional-grade execution with the agility of an independent. Their market insight and responsiveness have transformed how we manage our FX exposure.”

— Group Treasurer, FTSE-listed Company (£500M+ Turnover)

Overview

-

We help you manage foreign exchange exposure with tailored hedging strategies, protecting your business from currency volatility and delivering long-term price certainty.

-

We act as your outsourced FX desk, advising on timing, structure, and strategy — so you're not just reacting to the market, you're leveraging it.

-

Access our global network of regulated liquidity providers to achieve better pricing and execution — without the bureaucracy of traditional banks.

-

We support your international transactions with tailored trade finance solutions — improving cash flow, reducing risk, and helping you move faster in global markets.

Globally Connected.

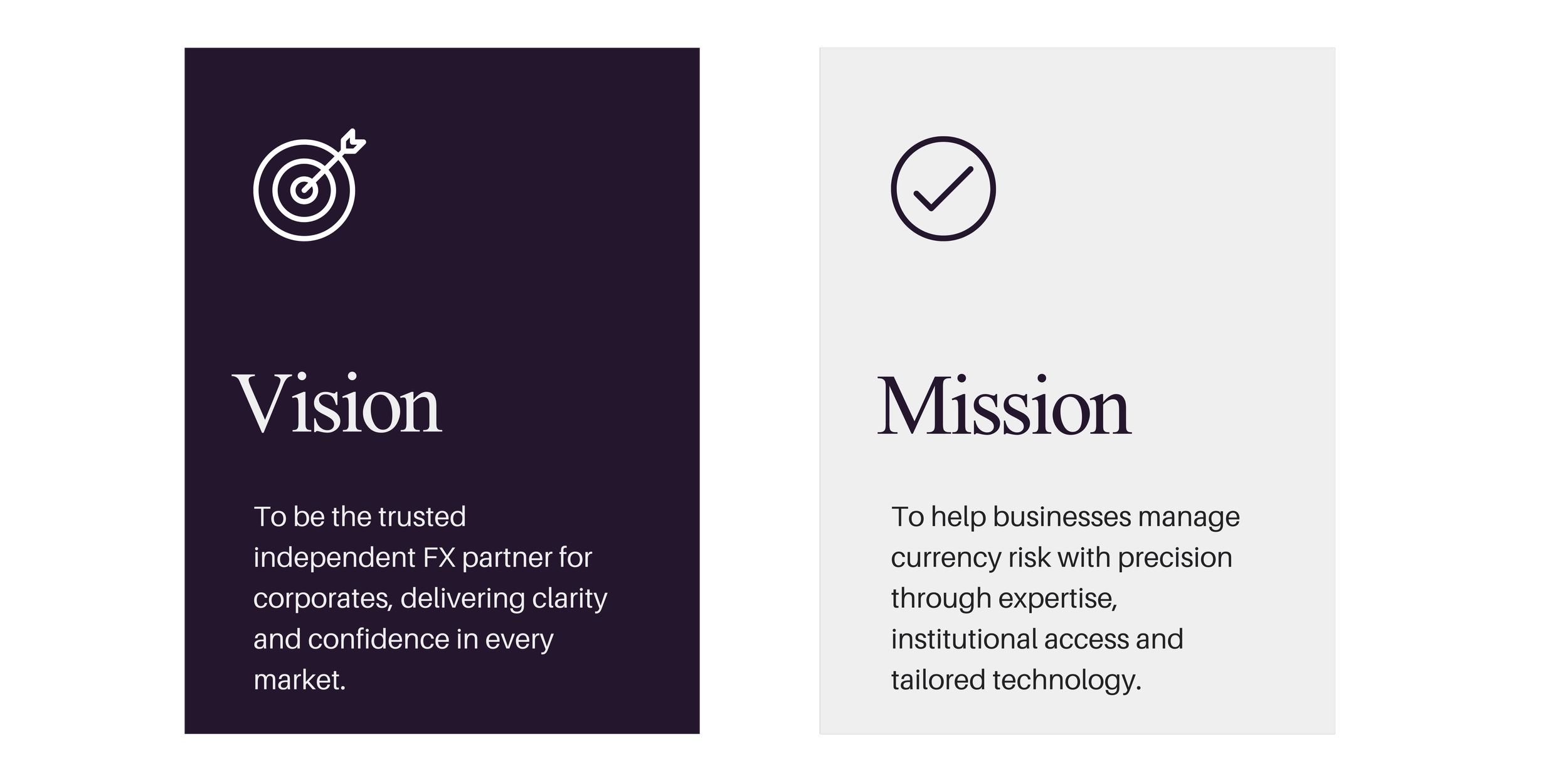

Monroe Global is an independent FX advisory and brokerage, connecting corporates to the world’s leading counterparties.We help businesses manage currency exposure with tailored structures, transparent pricing, and complete market coverage — all without the conflicts of a single-provider model.

Our focus is simple: precision, access, and independence in every trade.